Jul

FASB Issues ASU on Leases

Summary

On February 25, 2016, the FASB issued its highly-anticipated leasing standard for both lessees and lessors. Under its core principle, a lessee will recognize lease assets and liabilities on the balance sheet for all arrangements with terms longer than 12 months. Lessor accounting remains largely consistent with existing U.S. GAAP. The new standard takes effect in 2019 for public business entities and 2020 for all other entities.

MAIN PROVISIONS

Lessee Accounting Model

The new standard applies a right-of-use (ROU) model that requires a lessee to record, for all leases with a lease term of more than 12 months, an asset representing its right to use the underlying asset for the lease term and a liability to make lease payments. The lease term is the noncancelable period of the lease, and includes both periods covered by an option to extend the lease, if the lessee is reasonably certain to exercise that option, and periods covered by an option to terminate the lease, if the lessee is reasonably certain not to exercise that termination option.

HCC Observation: “Reasonably certain” has the same meaning as “reasonably assured” under existing U.S. GAAP, and includes an assessment of economic incentives.

For leases with a lease term of 12 months or less, a practical expedient is available whereby a lessee may elect, by class of underlying asset, not to recognize an ROU asset or lease liability. A lessee making this accounting policy election would recognize lease expense over the term of the lease, generally in a straight-line pattern.

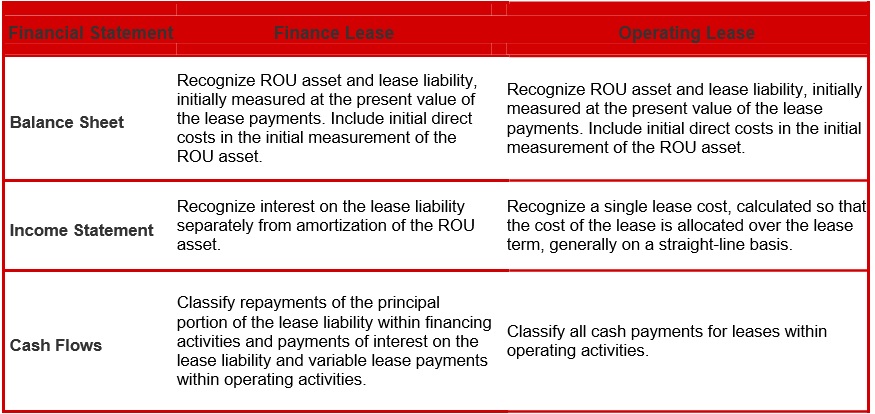

At inception, lessees must classify all leases as either finance or operating. Balance sheet recognition of finance and operating leases is similar, but the pattern of expense recognition in the income statement will differ depending on the lease classification. A finance lease is a lease arrangement in which the lessee effectively obtains control of the underlying asset. In an operating lease, the lessee does not effectively obtain control of the underlying asset.

If any of the following criteria is met at commencement, a lessee effectively obtains control of an underlying asset and will account for the lease of a finance lease:

- The lease transfer ownership of the underlying asset to the lessee by the end of the lease term.

- The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

- The lease term is for the major part of the remaining economic life of the underlying asset.

- The sum of the present value of the lease payments and the present value of the residual value guaranteed by the lessee amounts to substantially all of the fair value of the underlying asset.

- The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

The following table compares lessee accounting for finance and operating leases:

HCC Observation: Finance leases will result in a “front-loaded” expense effect due to straight-line amortization and front-loaded interest, while operating leases will result in straight-line expense recognition over the lease term, similar to today’s operating lease treatment.

After inception, the lessee’s right-of-use asset will be assessed for impairment under Topic 360.

Lessor Accounting Model

The new standard requires a lessor to classify leases as either sales-type, direct financing or operating, similar to existing U.S. GAAP. Classification depends on the same five criteria used by lessees plus certain additional factors. Based on that evaluation:

- A lease will be treated as a sale if it transfers all of the risks and rewards, as well as control of the underlying asset, to the lessee.

- If risks and rewards are conveyed without the transfer of control, the lease is treated as a direct financing.

- If the lessor doesn’t convey risks and rewards or control, an operating lease results.

The subsequent accounting treatment for all three lease types is substantially equivalent to existing U.S. GAAP for sales-type leases, direct financing leases, and operating leases. However, the new standard updates certain aspects of the lessor accounting model to align it with the new lessee accounting model. For instance, glossary terms have been standardized such as a lessee applying the guidance as a sublessor would apply the same terms as a lessor. Further, guidance for lessors has been aligned with the revenue recognition guidance in ASU 2014-09 due to the revenue-generating nature of leasing activities for lessors. Specifically, determining whether a lease is a sale is based on the notion of transfer of control, which is the same principle underlying the new revenue guidance, a lessor is precluded from recognizing selling profit or sale revenue at lease commencement for a lease that does not transfer control of the underlying asset to the lessee. Also consistent with the new revenue guidance, the updated lessor accounting model does not differentiate between leases of real estate and leases of other assets.

With respect to impairment, Topic 310 applies to a lessor’s net investment in the lease. Topic 360 continues to apply to long-lived assets of lessors.

Additional Considerations

Identification of a Lease – The new standard defines a lease as a contract that conveys the right to use an underlying asset for a period of time in exchange for consideration.

HCC Observation: Determining whether a contract contains a lease at inception is critical under the new guidance because of the requirement to recognize ROU assets and lease liabilities on the balance sheet. While this assessment will be straight-forward in most cases, it may require judgement in some situations, such as contracts that include services.

Components – Lessees and lessors are required to separate the lease components from the nonlease components (for example, maintenance services or other activities that transfer a good or service to the customer) in a contract, and account for the nonlease components according to other applicable guidance. However, a practical expedient is available whereby lessees may elect, by class of underlying asset, not to separate lease components from nonlease components, and to account for all components as a single lease component.

Sale and Leaseback Transactions – For a sale to occur in the context of a sale and leaseback transaction, the transfer of the asset must meet the requirements for a sale in ASU 2014-09. If there is no sale for the seller-lessee, the buyer-lessor also does not account for the purchase.

Modifications – The new standard provides guidance for determining whether lease modifications should be accounted for as separate leases. It also specifies the modification accounting for both lessees and lessors.

Disclosures – Lessees and lessors are required to provide certain qualitative and quantitative disclosure to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.

Other – The new standard provides guidance on combining contracts, purchase options, reassessment of the lease term, and remeasurement of lease payments. It also contains comprehensive implementation guidance with practical examples.

Effective Date and Transition

The amendments are effective for public business entities for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The amendments are effective for all other entities for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted.

In transition, a lessee and lessor will recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedient. These practical expedients relate to identifying and classifying leases that commenced before the effective date, initial direct costs for leases that commenced before the effective date, and the ability to use hindsight in evaluating lessee options to extend or terminate a lease or to purchase the underlying asset.

An entity that elects to apply the practical expedients would, in effect, continue to account for leases that commenced prior to the effective date in accordance with previous guidance unless the lease is modified, except that leases would recognize an ROU asset and a lease liability for all operating leases at each reporting date based on the present value of the minimum rental payments that were determined under previous guidance.

The new standard also provides transition guidance specific to sale and leaseback transactions, build-to-suit leases, leveraged leases, and leases recognized as a result of a business combination.

International Convergence

The lease project began as a point project with the IASB. The IASB released its final standard, IFRS 16 Leases, in January 2016. Although many aspects of the two standards are converged, there are significant differences, the most notable of which is the lessee accounting model. IFRS 16 does not differentiate between finance and operating leases, but rather treats all leases of assets with values greater than $5,000 as finance leases. This means leases classified as operating leases under U.S. GAAP will be accounted differently than under IFRS, resulting in different patterns in the income statement and cash flow statement.